With Redfin's (NASDAQ:RDFN) stock price in a downward spiral, currently almost back to its original IPO price, it got me interested in researching the company. I'm a licensed real estate agent in California and work full-time in real estate. At first I was quite skeptical of Redfin, but, after further due diligence, I believe it's primed for continued market share gains and has an exciting business model.

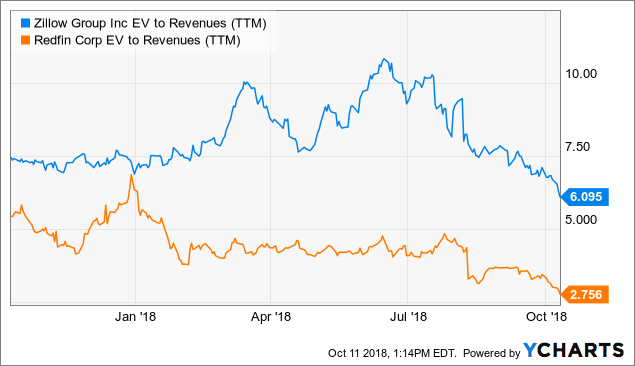

The valuation is still pricey at just under 3 EV to TTM revenues, but well under the valuation of Zillow (NASDAQ:Z) and other high-growth companies. The business is still growing strongly with 36% YOY growth in the most recent quarter, but growth is expected to slow somewhat in the third quarter.

Excitingly, the company has a large addressable market and is investing in innovative new services including: technology-focused tools for it customers, in-house title and escrow services, in-house mortgage services, direct-buying, and its concierge service. Growth to its website and app is still strong but slowed from 28% in the first quarter to 18% in the second quarter. This may be due to a slowdown in the real estate market.

Z EV to Revenues (TTM) data by YCharts

Z EV to Revenues (TTM) data by YCharts

There's no question it's a risky investment. Redfin needs to hire agents to scale, so it won't have high profit margins anytime soon. Redfin's business model is unproven, and it's unclear how profitable the business will be long term.

I believe Redfin's low fees ensure the company should be able to keep growing market share, so right now I'd feel comfortable making it a large position in my portfolio if the valuation gets significantly more attractive.

Consequently, I've bought a small position in the company. Management indicated a slowdown in the real estate market at the end of the last quarter which triggered the recent selloff. Rising interests rates and low inventory are a headwind for Redfin's business. But with housing starts nowhere near a sustainable long-term level, a crash in real estate is unlikely anytime soon. If Redfin can continue to gain share and add services, the stock could be a real outperformer.

Growing Market ShareRedfin is continuing to gain market share and was involved in 0.83% of all second quarter U.S. home sales. The value proposition of Redfin is simple. It charges much less than a traditional agent/brokerage to sell a home and uses technology and its own employees to guide sellers and buyers through the process.

Sellers are generally charged 1 to 1.5% of the purchase price versus 2.5% to 3% from a typical real estate agent/brokerage. When Redfin represents a buyer, Redfin pockets the commission offered by the seller and reimburses the buyer a percentage of the commission. The seller normally pays the buyer's agent's commission. As a result, buyers aren't as enticed by Redfin's discounted services since they don't pay a commission when buying a house.

Redfin's current strategy is to decrease the buyer's refund it currently offers and in turn lower its seller commissions down to 1% in more and more markets. A 1% commission is a huge selling point, and the more homes for sale by Redfin, the more Redfin agents are visible in the community which should drive more buyers to use Redfin's services despite lower refunds.

Ultimately, Redfin's agent efficiency will determine whether the company is a long-term success. The company claims its agents are already much more productive.

Employed lead agents who, in 2017, were on average three times more productive, and earned a median income that was twice as much as agents at competing brokerages; our lead agents were also 26% more likely to stay with us from 2016 to 2017 than agents at competing brokerages.

With Redfin's agents all being employees, the company is in a unique position to offer differentiated tools and services that low-margin brokerages don't have the scale to offer.

As Redfin adds more and more homes listed for sale, it drives increased traffic to its website/app and ultimately increases business to the brokerage. Real estate is local. Establishing a strong local network and a good reputation in the community is crucial for real estate agents to be successful. Redfin is going through the same process. It's still very new to people and it takes time to gain trust.

In my opinion, buyers and sellers have traditionally cared more about the individual agent than what brokerage the agent is a part of. Crucially for Redfin, customers' loyalty is more to its brand than to its agents.

Redfin assigns one of their agents to specifically work with a buyer or seller to ensure a personal relationship. The support team is there to back up the agent and do some of the grunt work like scheduling showings and handling paperwork. This is the right way to do it; buying a home is a long process and can be stressful and frustrating. Crucially, evidence points to Redfin's clients giving the company's services high ratings. The reviews on Yelp seemed very encouraging to me. The reviewers often mention the agent they worked with by name which shows how personalized Redfin's service is.

This starts with repeat business. When a customer decides to sell the home that she originally bought via brokerage, her likely to use that same brokerage is now 69% higher if she bought that home with Redfin rather than through another brokerage.

For 2016, it was only 42% higher. So Redfin's advantage in customer loyalty is widening. Our advantage in customer's likelihood to refer a friend to use our service is also growing. We measure this likelihood as a net promoter score, which takes the difference between the number of customers who love us and the number who don't, then divides that by the total number of customers who respond to the survey.

In May 2017, our net promoter score was 32% better than other brokerages, but a year later, that gap has now widened to 50%. In six surveys over three consecutive years, we've gotten a similar result.

The company currently refers interested buyers and sellers, that come through its website, to traditional real estate agents in cities it doesn't offer services yet and collects a referral fee from the agent. This speaks to how powerful Redfin's platform is nationally. As the company expands across the country, it can drive growth by using Redfin agents instead of recommended realtors and get the full commission rather than a referral fee.

A Unique Integrated ServiceRedfin has a number of initiates that will drive higher gross margins and revenue. It's expanding nationwide in areas like escrow services, mortgages, and its concierge service. All of these services are not generally provided by traditional agents. As it integrates more and more customized services into its business, Redfin can streamline the real estate process, helping remove frustrations that realtors aren't equipped to solve themselves.

At traditional brokerages, real estate agents are independent contractors and given freedom to basically run their own business. Redfin offers its employees a more stable income and benefits like health care and paid time off. Also, with other agents able to step in and help, a Redfin agent may find it easier to have more of a work-life balance which is something traditional real estate agents struggle with.

And we're just getting started. Because we're one of the only major brokerages building virtually all of our own brokerage software, our gains in efficiency, speed, and quality are proprietary... And finally, because we hire our own lead agents as employees, we can set data-driven best practices for selling homes, with our software tailored to those practices, creating a positive feedback loop between software and operational innovations that we believe differentiates us from traditional brokerages. Moreover, we believe listing more homes and drawing more homebuyers to our website and mobile application will let us pair homebuyers and home sellers directly online over time, further improving our service and lowering our costs.

Change has been slow to come to the industry. One big change which unquestionably alters realtors' control over the process is the rise of Zillow and other similar websites. It might not seem like a big deal, but being a member to the local MLS (Multiple Listing Service) was at one time the only way to see what homes were for sale. Redfin and sites like Zillow get listings directly from the local MLS. Buyers, especially millennials, increasingly start their house search online instead of relying on a realtor to send them listings.

Redfin's website allows you to directly book a tour instantly, and you can choose whether you'd like to go by yourself or meet a Redfin agent there. While this is not possible for all homes, it's extremely convenient and will likely become increasingly used.

You can't book a showing instantly on Zillow. The process is still handled by realtors who setup appointments via email or phone and generally use lock-boxes that only agents can access. But with Redfin, I just went to the website and picked a time and was almost instantly confirmed for my appointment. If a person wants to meet a Redfin agent, Redfin can accommodate a buyer's schedule as any Redfin agent could meet the buyer at the property.

The entire solution depends on a listings search website, a customer database, a team structure, and a mobile capability that few brokerages can deliver. In the fourth quarter of 2017, nearly 80% of Redfin customers scheduled home tours automatically

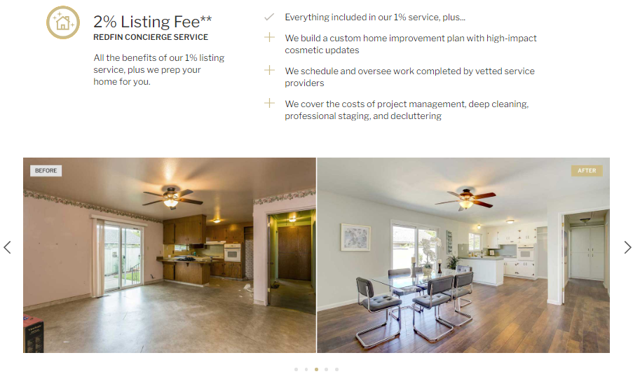

Another service offered in select markets is Redfin Concierge Service. For an additional 1% listing fee, Redfin can make sellers' homes dramatically more salable.

This is only available in select markets right now, but it's easy to see the potential to roll this out nationwide. Sellers hate all the work associated with getting a home ready for sale so this could be a significant revenue driver.

Mortgage and title services are another area Redfin is now providing its own in-house option for. In California, a title company plays a crucial role in a transaction and helps facilitate the sale by providing title insurance and a number of escrow and title-related services. In my experience, buyers and sellers generally don't have a strong relationship with specific title companies or escrow officers as transactions generally happen many years apart. So the real estate agent almost always picks the title company and escrow officer. There is little keeping buyers and sellers from avoiding traditional title companies entirely.

Title Services Our experience with Title Forward, our title and settlement business, demonstrates that many Redfin customers are open to buying more services from us. In 2017, in the ten states where Title Forward operated, 52% of our homebuyers also chose our title and settlement service.

Right now the title business is small, but it'll be fascinating to see how fast Redfin can scale this business. Other real estate startups are also getting into the title business. Direct home-buying startup Opendoor has its own in-house title service and brokerage startup Compass will likely try to do something similar.

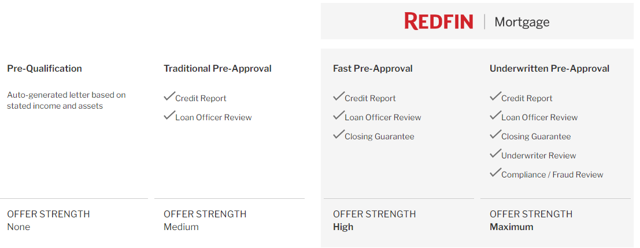

Redfin's mortgage service, started in 2017, offers buyers some protection, as it promises to close your mortgage in 25 days or you'll get a $1,000 credit. Plus Redfin doesn't charge any lender fees.

Lender issues are a common holdup in a transaction. Once the buyer gets into escrow, they have a certain amount of time to remove their loan contingency. If there is a delay and the buyer can't meet the deadline, they could potentially lose out on the home.

If Redfin can provide an efficient and reliable service, many of its existing real estate customers could switch to using Redfin Mortgage. Crucially Redfin will limit its credit risk as much as possible, as Redfin intends to sell every loan to third-party investors.

Redfin is also launching new tools to help buyers/sellers make more informed decisions.

An Owner Estimate can be created by the homeowner of any off-market or recently sold home. To create an Owner Estimate, the homeowner goes through a step-by-step process to update home facts and provide input on completed renovations, such as whether the homeowner has added any bedrooms or bathrooms. The homeowner then selects at least five comparable homes from a list of 25 recently sold homes in the area...

"One of the most frequent requests we get from homeowners is to be able to provide their own input and additional information that could impact the estimated market value of their home," said Karen Krupsaw, senior vice president of real estate operations who oversees the home-selling business at Redfin. "The Redfin Owner Estimate puts the power of our proven machine-learning algorithm into the hands of consumers, so they can have a more accurate picture of their home's value whether they are preparing to sell or simply want a better understanding of their equity."

With how fragmented the industry is, the current real estate industry never had an incentive to develop tools like this.

The residential brokerage industry is highly fragmented. There are an estimated 2,000,000 active licensed agents and over 86,000 real estate brokerages in the United States.

It's smart to give homeowners the opportunity to provide input. In my experience, most owners have a strong opinion on what their home is worth.

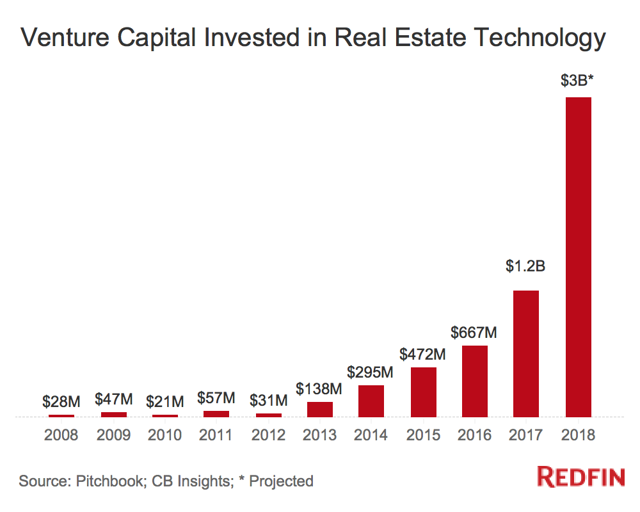

Startup CompetitionVenture capitalists have long ignored the industry, but recently venture capital invested in real estate has exploded.

Redfin's enterprise value, close to $1.2 billion currently, is significantly less than private startups such as direct home-buyers like Opendoor and technology-oriented brokerages like Compass. Opendoor's fees seem to be falling as it scales. From what I can tell, Opendoor charges 6-8% to sellers down from between 8% to 14% when it first started. Redfin and other companies like Zillow have started copying Opendoor by getting into the direct home-buying business too.

With the existing agents and brand awareness that Redfin has, this is the right move. It's a low margin business, but it's currently about break-even and Redfin is conservatively expanding. Conveniently, Redfin can offer the option of either listing your home at a very discounted rate, compared to Opendoor, and give sellers a guaranteed option to sell their home directly to Redfin at date of their choosing. Redfin, unlike Zillow, already has real estate agents who can sell the homes.

Newer entrants don't have the online audience we do, and pure websites don't have as much operational expertise. We believe few companies have our spending discipline. This audience field experience and penny-pinching should let us acquire and sell homes at a lower cost, which will let us offer homeowners more money. For the person selling her home to Redfin Now that money is almost all that matters, and a war on price is the one we feel best prepared to win.

Zillow earns most of its revenue from agents advertising on its site, so it will find it much harder to transition to direct buying without alienating the agents it depends on. Redfin has growing brand awareness in real estate, and it is already setup to be efficient in the direct home-buying business.

The margins on direct buying are low, but this is just one growth strategy the company is pursuing. By bundling real estate, title, mortgage, and additional future services, the company has a chance to deliver a streamlined and multi-faceted service to its customers.

OutlookRedfin's gross margin has been declining as the company invests heavily on improving its personal service and growing new businesses. Management expects its mortgage and title businesses to have similar gross margins as the brokerage business, but it will take several years as the businesses are still relatively new.

So your assumption is correct, that agent productivity is going to be the most powerful lever for increasing or decreasing gross margins. The other factor you should just consider is how much of our revenues come from new businesses that are too nascent to have higher gross margins. So the more we get from Redfin Now title, mortgage, the lower our gross margins will be as a percentage, just because those businesses are still new.

Technology and development expenses have been decreasing as a percentage of revenue, but Redfin is spending heavily on advertising as it expands to new markets.

The company has been consistently growing revenue, and should benefit more and more from repeat business and referrals. The company generally posts a large loss in the first quarter as it has to increase hiring and other expenses as, after the holidays, the real estate market activity starts to pick back up. However, the company posted a positive net income in the second and third quarter and expects net income to be positive in the fourth quarter even as it invests in its future.

So our outlook on agent hiring is really affected by our outlook on the overall market. We're not hiring agents this quarter to close sales this quarter or to close sales next quarter. All of our hiring is going to be about 2019, most of it will happen in the fourth quarter. We ramped earlier last year, because we knew we are going to invest in more personal service.

If the real estate market slows down, Redfin won't have to invest so heavily in the coming first quarter. While I don't like investing in companies that lose money, Redfin's losses are reasonable, and with so many opportunities, it makes sense to invest strongly in its future.

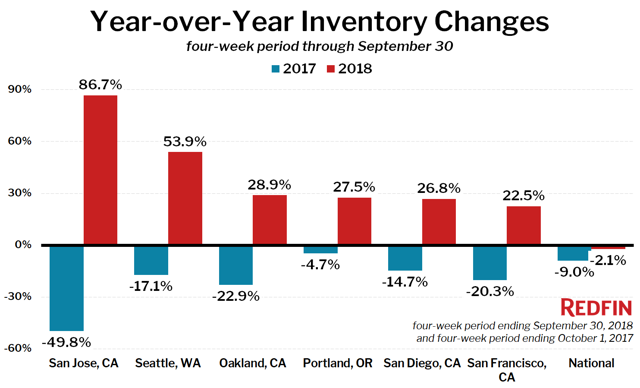

The price of a home and national sales volume drive Redfin's brokerage business. And with west-coast markets being six of Redfin's top ten markets, these markets are a crucial part of Redfin's business. Supply has been tight for years and prices have surged in most of these markets, but recently inventory has surged.

The main reason for this is sales have stagnated causing inventory to sit longer on the market. This is likely the main reason Redfin's growth has slowed somewhat. While more inventory doesn't directly translate to more sales, a lack of inventory can turn off buyers and decrease demand. With more inventory, price increases should soften, making purchasing a home easier for buyers.

In the rest of the country, inventory was basically flat recently. This has been an issue for years. Home sales struggle to grow if there's a lack of inventory. The crisis in 2008 caused home-building to virtually stop, and after all this time housing starts still aren't high enough given the US's population growth.

Inventory has declined year-over-year for 34 consecutive months, with signs release in site. The number of listings on April 30, 2018 was 8.4% lower than it was a year prior. And since 2010, the number of residents per home for sale in coastal markets like San Jose, Seattle and Boston, has tripled and in once affordable cities like Denver and Portland it is double. In Seattle Redfin, Redfin alone had almost as many home buying customers for the month of April as there were homes for sale on any given day, and Redfin has less than 5% shares here. And it's not just Seattle. Of the 86 markets in which we employ agents, the only Redfin market where we have not had reports of frequent bidding wars this year is Oklahoma City, which has been hurt by low oil prices.

While this isn't likely to change in the short term, over the long term, inventory should recover as increasing prices make building more economical. So growth in inventory will be a long-term tailwind for Redfin, especially on the buy-side.

Risks Realtors cut their pricing to better compete with Redfin, eliminating Redfin's pricing advantage. Opendoor gets so much scale that it can offer lower fees and convenience that Redfin can't match profitably. Brokerage startups like Compass and other existing players improve their technology and convenience, and Redfin is unable to differentiate its services. Compass recently raised $400 million at an over $4 billion valuation, so it has plenty of money to drive consolidation in the industry and invest in technology. No buybacks or dividends will likely happen for a long time as the company focuses on growing. Current customers do not turn into repeat customers and fail to become a source for referrals. Technology doesn't make Redfin's agents more productive, making it difficult for Redfin to be profitable. ConclusionWith the real estate industry changing significantly and large amounts of money going to real estate startups, it's unclear how the real estate industry will evolve. But the risk-reward looks favorable as Redfin's business is tiny compared to the size of the residential market. Its low pricing and technology should ensure a certain percentage of the population will choose Redfin.

With an EV to revenue below 3, Redfin is much cheaper than other fast growing public companies. Gross margins should start growing again in a year or two as it continues to gain scale. Profit margins will likely never be huge, but there is a large addressable market. Redfin's one percent listing fee will buy it market share, and its long-term investment in technology and its brand will ensure its success.

Disclosure: I am/we are long RDFN.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am a licensed real estate agent in the state of California.

No comments:

Post a Comment